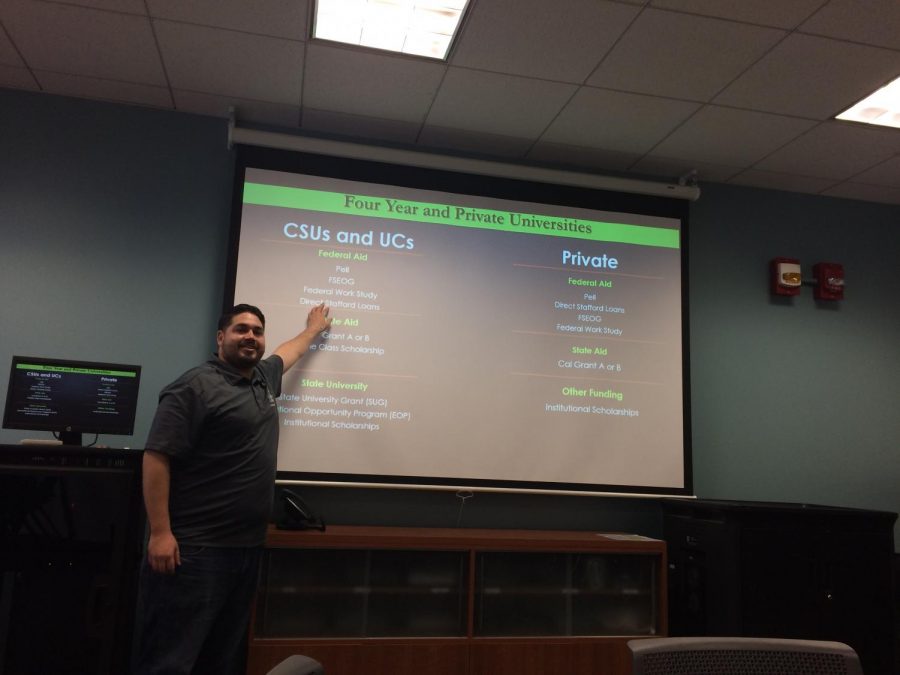

As a part of the Spring 2018 Financial Aid Workshop Series, the Financial Aid Resource Center held a workshop discussing the importance of financial aid and aid available (such as grants, scholarships, and loans) for those who are getting ready to transfer to a four-year or private university.

Held on Feb. 6 from 11 a.m. to 12 p.m., the workshop was led by Ulysses Valencia, an employee of the Financial Aid office on campus.

Valencia discussed the basics of financial aid from the important dates and deadlines to specific grants and aid available, to ensure students can finance their education when they transfer.

“You did all this work to transfer, so you should know how pay for it,” he said.

With the application for FAFSA open Oct. 1 and with a strict March 2 deadline for transfer students, Valencia stressed the importance of completing it early. The earlier it can be completed, the better chance a student has to receive as much money as possible through various grants and aid available.

“Money can only go so far,” Valencia said.

The workshop discussed the aid that is available to students depending on where they are going. CSU, UC and private university transfer students can look into receiving federal aid through Pell grants, Federal Supplemental Educational Opportunity Grants, Federal Work Study, and Direct Stafford Loans.

There’s also State Aid such as Cal Grants A & B and Middle Class Scholarships. Valencia mentioned that looking into scholarships for transfers attending a private university was also recommended.

For example, Valencia discussed the state aid offered through Cal Grants, which pays for tuition and fees at the university level.

When discussing scholarships, he stated that not only are they limitless, but it’s money that never has to be paid back and can often be overlooked.

In order to qualify, an application needs to be filled out including the basics such as name, email, gpa, etc., a personal statement, and two letters of recommendation, which can written by counselors or professors.

Discussing loans he mentioned it’s important to understand the distinction between unsubsidized and subsidized.

While both will require repayment after graduation, leaving school, or being enrolled less than six units, the one that is strongly recommended is subsidized loans. Valencia recommended those compared to unsubsidized because no interest is charged while enrolled.

Additionally he mentioned to be cautious with private lenders — banks such as Chase, Wells Fargo, Credit Union, etc. — because their interest can accumulate and the time period of repayment can vary.

To sum up, Valencia said that it’s important to follow up with your transfer school to ensure your financial aid is properly dispersed to you.

“You apply to finance yourself and there’s more money at stake,” he mentioned. From FAFSA to loans and scholarships, it is vital you have the funds available to continue with your education.

Aside from the financial aid workshops available, the campus will also be hosting a Financial Aid Awareness Fair on Feb. 13 from 10:30 a.m. to 1 p.m. to offer additional information about financial aid in front of the library.