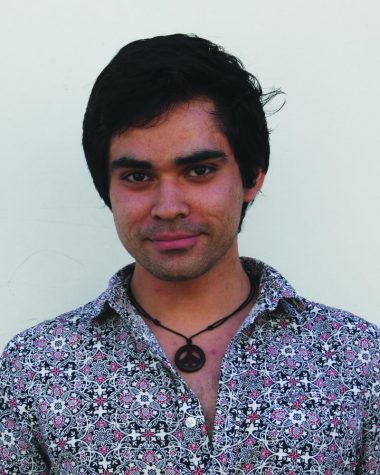

Jovian Orozco, architecture major, leaned about scams and how to keep accounts safe at the second of two Basic Banking workshop held on Wednesday, March 22 in the Learning Center.

Financial wellbeing coach with Operation Hope Isabel Duran, who gave the workshop advises the student body of Cerritos College to be careful with money: Put income ons either a bank of credit union to safe-guard it so that it can be secure, look for banks and credit unions that don’t charge a large number of fines for checkings or savings accounts, knowing how much money is in an account so that it doesn’t get overdrafted.

Orozco is now sure to cut down on unnecessary spending, saying that he will be sure to save as much as possible; which is what Duran advised during the workshop.

Orozco went on to note that the basic method of avoiding scams is to freeze your account for 90 days concluding that “this workshop teaches you how to be safe with money.”

Duran also brought to light the fact that online banking can be used to pay bills, get cash or by purchases.

The website of Operation Hope, the non-profit Duran works for, states that the mission of the organization is to make “free enterprise work for everyone,” accomplishing “this through […] work on the ground as the non-profit private bankers for the working poor, the underserved and struggling middle class,” and that they achieve their mission by being the “best-in-class provider of financial literacy empowerment for youth, financial capability for communities, and ultimately, financial dignity for all.”

It is part of Isabel Duran’s job to give presentations to educate the public on basic banking.

Duran explained the difference between banks and credit unions by crying out the following:

“The bank is an institution that offers the ability to deposit your money in a savings; it’s secured and ensured through the Federal Deposit Insurance Corporation.”

According to its website, the FDIC preserves and promotes public confidence in the U.S. financial system by insuring deposits in banks and thrift institutions for at least $250,000; by identifying, monitoring and addressing risks to the deposit Insurance funds; and by limiting the effect on the economy and the financial system when a bank or thrift institution fails.

“[Banks] offer loans and credit cards,” Duran continued, “They do make a profit, so they’re in the business to make money.”

She went on to explain that credit unions are comprised of memberships, from all the deposits, the loans and interest are funded.

This workshop is in light of a more global event, Americans are moving their money from banks to credit unions, in opposition to corporations supporting the Dakota Access Pipeline.

In a video for NowThis by Jash, comedian Sarah Silverman states that she pulled her money out of a bank and put it in a credit union, saying: “I realized that as long as my money is in a big bank, I am a part of the problem. Those banks are investing in big oil.”

Duran finished, saying: “I would love to come back if I am invited.”